How to use Crypto Options for speculation and hedging in StormGain

The potential returns you generate with crypto options hinges on your understanding of how to use them correctly. Our next step will therefore explore a variety of popular crypto options strategies and the best scenarios for each of them.

Speculation

Speculation tends to be a more short-term strategy, and is often deployed with the goal of realizing a bigger gain for a bigger risk. Crypto options allow you to speculate on the price movements of the underlying asset for a varying degree of risk depending on your appetite for it.

Speculative strategies with Crypto options

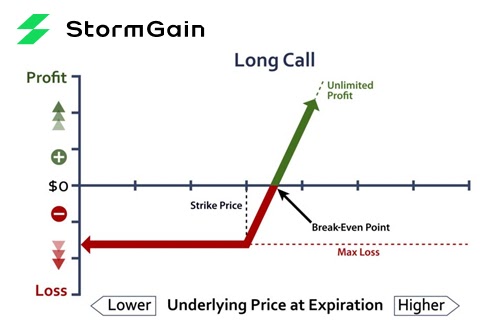

Long Call = Buying a Call Crypto option

Long calls can be great options if you’re bullish or believe the underlying crypto asset will go up over a longer period of time. It gives the options contract a longer period of expiry, and therefore more time for the asset to reach or exceed the strike price.

Example

If Bitcoin is currently trading at $10,000 and you believe it will go up to a higher price before the crypto option expiry date, you can take a position by purchasing a crypto call option.

Risk/Reward: In this case, the potential gains from your long call would be unlimited, and much higher than if you had invested in Bitcoin directly. Your loss, on the other hand, is limited to what you paid for the crypto option since it cannot go below 0, even if Bitcoin’s price is well below the strike price of the crypto option upon expiry.

Note: This strategy can be replicated if you believe that the price will go down over time via the form of selling/shorting a crypto put option. As the price lowers, the value of your put option would increase but the gain would be limited, since the value of the put cannot go below 0.

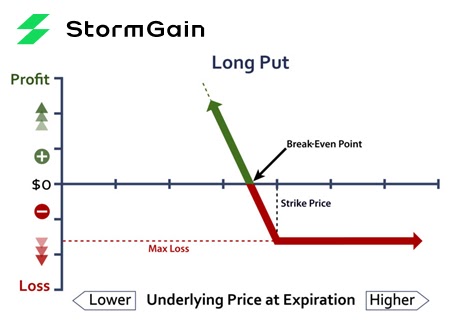

Long Put = Buying a Put Crypto option

This trading strategy is used when you’re bearish or believe an asset’s price will decrease in value. Furthermore, long puts enable you to leverage your positions since the change in the value of the option tends to be greater than the change in the value of the underlying asset.

Example

Continuing with the above example, if Bitcoin is currently trading at $10,000, and you believe it will be trading lower before the crypto option expires, you can purchase a put crypto option.

Risk/Reward: In this case, the potential gains from your put option would be unlimited, and much higher than if you had invested in Bitcoin directly. Your loss, on the other hand, is limited to what you paid for the crypto option since it cannot go below 0, even if Bitcoin’s price is well above the strike price of the crypto option upon expiry.

Note: This strategy can be replicated if you believe that the price will go up over time via the form of buying a crypto call option. As the price goes higher, the value of your call option would increase.

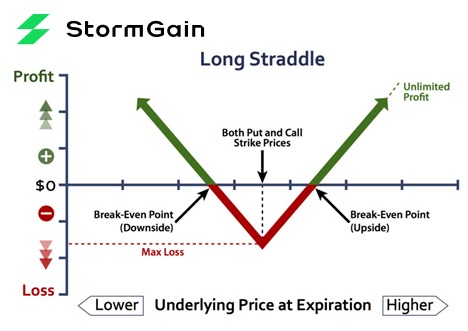

Straddle = Buying a Call and a Put Crypto option with the same strike price and expiry simultaneously on the same underlying asset

You can use this strategy if you expect that the volatility of an asset will increase, but are not sure of the direction. Straddling is therefore a commonly used approach around important announcements or news that can influence crypto prices sharply.

Example

Using Bitcoin as an example again, let’s say that there are a new set of regulations being discussed in the US that could affect the crypto market. As a trader, you may not know how it will influence crypto prices, but you expect them to move substantially in one direction or another. In this case, you straddle by purchasing both call and put crypto options with the same expiry for Bitcoin.

Risk/Reward: Let’s assume that after the actual announcement, the markets react positively and the price of the underlying crypto asset that you purchased options contracts for shoots up. You’ll incur a small loss on the put crypto option equal to the price you paid for it, and a large gain on the value of the call crypto option. The opposite would be true if prices dropped. You’d incur a loss on the call crypto option equivalent to the price you paid for it, and a gain on the put crypto option. In the case that the markets don’t respond to the event and prices do not change, both crypto options would slowly decrease in value as their expiry approaches.

Hedging

Hedging is an attempt to mitigate losses from your portfolio by taking reverse positions in the case of adverse price changes. One of the central purposes of options is to allow traders to hedge their positions at an attractive cost ratio.

Hedging strategies with Crypto options

Let’s imagine that you’ve made a profit on an investment in Bitcoin. Say that you want to go on an extended holiday and don’t want to follow the markets or trade during this time but also don’t want to sell your investment either. In that case, you can keep your Bitcoin holdings and additionally purchase some Put Crypto options on the same underlying asset.If Bitcoin goes up, you’ll make a profit on your holdings and a small loss on the Put Crypto option, thus maintaining the overall value of your holdings somewhat stable. Conversely, if the Bitcoin goes down, your losses on the index will be compensated by the gains in the price of the Put Crypto option. Finally, if Bitcoin remains flat, the value of the Put Crypto option will also not change much, and your holdings will remain relatively stable.

A note on leverage

As we hope we’ve made clear by now, crypto options are more volatile than their underlying assets, which can give traders more profit and loss potential. In fact, from one perspective, crypto options can be seen as taking leveraged positions in the underlying assets. Consequently, you must be careful when using leverage with crypto options. For extra precaution, we’ve capped the multiplier for trading crypto options on StormGain and recommend that you carefully consider the risk you’re willing to take before opening leveraged positions.

Now that you know the basics of Crypto options, the reasons why you may be interested in using them, and the strategies you can utilise, you’re ready to place your first few practice trades.

Why should I trade Crypto options?

Perhaps the main appeal when it comes to trading crypto options is that they provide a much higher level of volatility. The higher volatility translates into higher potential profits at a higher risk. The options model price structure makes it so that changes in the price of the underlying asset are multiplied to result in the option’s value. Therefore, crypto options result in much steeper price swings when it comes to the value of the option compared to the underlying asset itself.

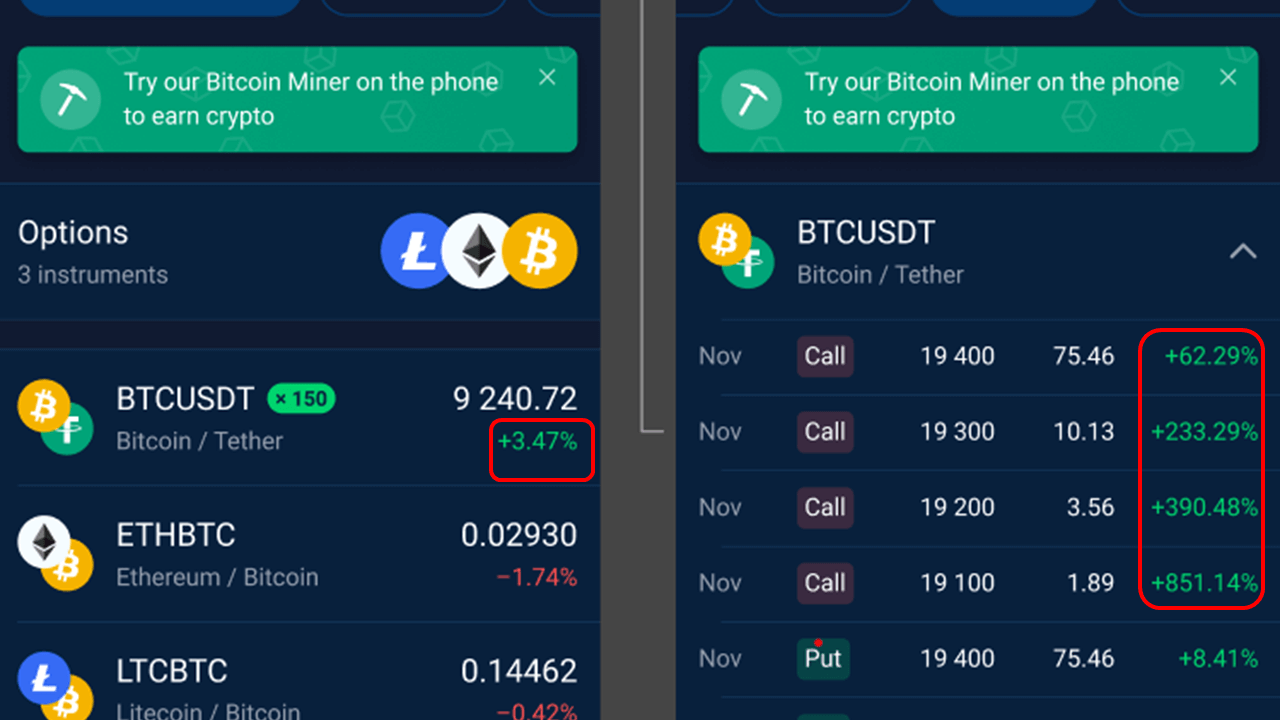

Much higher volatility on Crypto options compared with the underlying asset.

In the example above, you can see that Bitcoin is up 3.47% for the day. Notably, the corresponding price changes for the various Crypto options linked to Bitcoin range from 62.29% to 851.15%. This translates to price changes that are approximately 20 and 280 times greater.

More exposure

Crypto options allow you to take larger positions with the same amount of capital. The reason for this is that the price of options contracts tends to be significantly lower than those of the underlying asset. For example, a call option on Bitcoin may be around $100 dollars depending on your strike price. Let’s say for example that Bitcoin is trading near $10,000. In essence, you can trade the price changes of Bitcoin at a fraction of Bitcoin’s actual cost.

Example

Let’s stick with the Bitcoin example more. Say you think the price of Bitcoin will go up. If you were to buy Bitcoin itself for $10,000, and it jumps to $11,000, you would make $1,000 minus any associated transaction fees to successfully close out your position for a nice 10% return.

Let’s now imagine that you’ve invested the same amount to buy 1,000 call crypto options on Bitcoin, each costing $10, for a total of $10,000. The same $1,000 change in Bitcoin from $10,000 to $11,000 can easily multiply the price of crypto options by 8 to 10 times. While this does occur occasionally, let’s use a more conservative figure and assume that the price of the options increases by 5 times. In this example, if you were to close your position and sell your 1,000 crypto options at the new price of 50 (5 x 10), you would get 50,000 (1,000 x $50) (minus transaction fees). Therefore, you would have realised a 40,000 profit with the same 10,000 investment for a (40,000 / 10,000) * 100 = 400% return.

The above example serves to show the potential returns that crypto options can generate compared to investing directly in the crypto asset itself. While this example could be the case, the reverse is also true to a certain extent. With crypto options, you only stand to lose your initial investment. For example, if the price of Bitcoin falls dramatically after you purchased the $10,000 worth of calls, the most you would lose, no matter how much Bitcoin falls, would be $10,000 - the original price of the investment.

Therefore, it is advisable to invest only an amount that you are willing to lose and manage your risk by using an appropriate Stop Loss level.

Avoid some costs

Another interesting point about trading crypto options is that with them, you are not using overnight swaps. This serves to reduce overall trading costs, and could be particularly important in mid and long-term trading.

Now that you have a better understanding of the advantages and disadvantages for using crypto options, it’s now time to learn about some of the best strategies you can use with them.

What do I need to know about Crypto options?

Crypto options

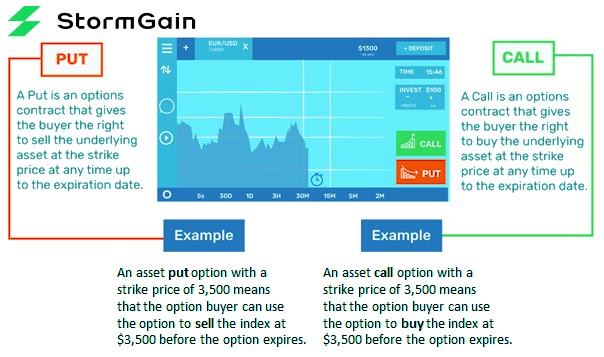

Crypto options differ from traditional options, in that they are derivative instruments that provide the ability to trade on the price fluctuations of the underlying crypto asset without the necessity of actually owning the crypto asset itself. When trading crypto options, you’ll be gaining or losing the difference between the opening and closing price of the position, depending on where it was trading when the crypto option contract was activated.StormGain gives you the power to trade crypto options on a variety of different crypto assets. The crypto assets that can be traded as options can be found in the platform’s Options section, listed as a subsection of the specific crypto asset. Here you will find the different types of options contracts, such as calls and puts, along with expiry dates and strike prices.

Example

For example, below you can see Call and Put options on Bitcoin, expiring in November with strike prices ranging from 19,100 to 19,400.

The key difference between crypto options as derivatives here and traditional, physical options, is that with crypto options, you will not be able to buy the underlying asset at the specified price before expiry. Rather, you’re solely trading the price fluctuations of the underlying asset.

Crypto options vs traditional options

Now that we’ve covered the basics on crypto options, let’s go over some of the basics about traditional options to help you trade even more confidently. Traditional options are derivative financial instruments whose value is determined by the underlying asset, such as a stock, commodity, or equity index. They provide traders the option, but not the requirement, to buy or sell a specified amount of the underlying asset at the price it was trading at when the contract was initiated. Because this is not a requirement, they do not oblige the trader to buy or sell, which allows for greater flexibility.- Call options give the owner the right to buy the underlying asset at a predetermined price within a certain time frame.

- Put options give the owner the right to sell the underlying asset at a predetermined price within a certain time frame.

- The underlying asset is the financial instrument whose price fluctuations determine whether the value of the option goes up or down.

- The strike price is the price at which the underlying asset can be bought, in the case of call options, or sold, with put options, if they are exercised by expiry.

- The expiry, often referred to as the expiration date, is the specified time frame for which the option can be exercised. The period between opening and expiry is known as the “time to maturity.” Please note that the crypto options offered on StormGain expire automatically at their expiration date, meaning that the position will be closed automatically if not sold by then. It’s therefore important to keep a close eye on your crypto options contracts.

What determines the price of Crypto options

Without spending hours going into excessive details and financial formulas, it’s enough to say that the following key points determine the value of crypto options:- The price of the underlying asset is a central determining factor.

- Market volatility is an additional key factor of the price and value of crypto options. Higher volatility typically translates into a higher price for the associated crypto options.

- The date of expiry also influences the price. The greater cushion of time between opening and expiry, the greater the chance is that the option will reach or exceed its strike price. Options with far out expiration dates are known as leaps, and are typically more expensive.

- Lastly, the supply and demand for specific crypto options will influence price.